Hurricane Ian to test Floridians' capital despite reinsurance scheme

As well as threatening re/insurers' capital position, catastrophic hurricane losses would add further upward pressure on reinsurance rates, which are already increasing

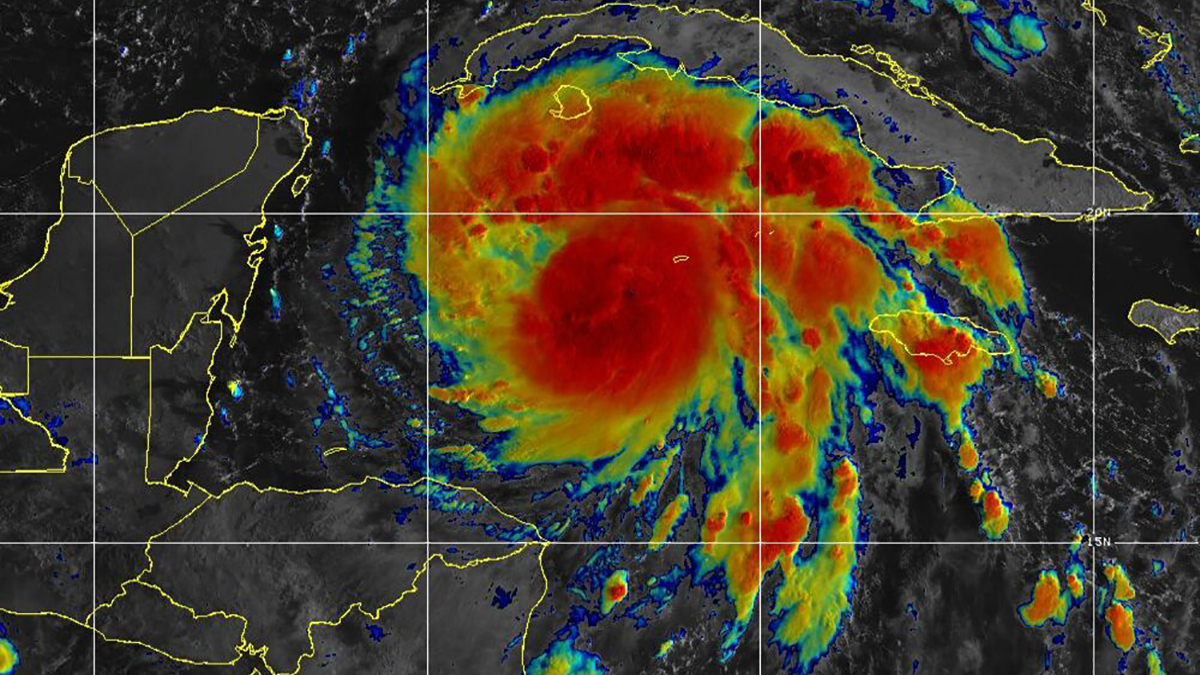

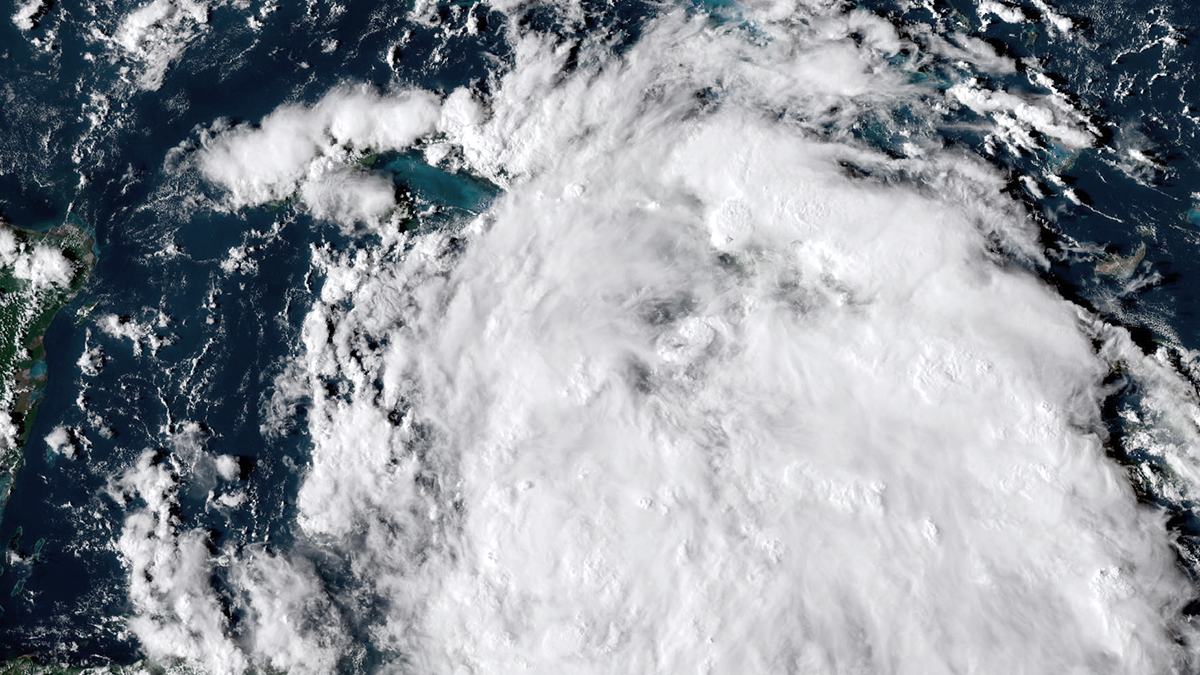

Newly minted $2bn state reinsurance programme to be tested by approaching storm amid fears losses could be comparable to 1992’s Hurricane Andrew

Losses from Hurricane Ian could still put pressure on Florida insurers’ capitalisation despite the state’s newly created state reinsurance programme, analysts have warned.

Hurricane Ian will be the first test of the reinsurance programme, which is a temporary arrangement to stabilise the state’s troubled property insurance market. It provides $2bn of coverage for hurricane losses to insurers that otherwise might not be able to buy it in the private market.

The reinsurance programme will come under pressure if Hurricane Ian hits densely populated areas such as the Tampa/St Petersburg area, where homes are larger and the insured value per home is higher, AM Best said.

“Although the reinsurance programme provides some capital insulation, it is not expected to make insurers’ programmes completely whole, as compared with protection purchased in previous years,” Chris Draghi, associate director at AM Best, said.

“In a hardened reinsurance market where capacity and the cost of coverage has been significantly altered, Hurricane Ian could add to the capital pressure faced by those insurers that are thinly capitalised and have not been able to secure appropriate reinsurance.”

In addition, catastrophic hurricane losses would add further upward pressure on reinsurance rates, which are already increasing.

Analysts said a landfall in the populous area around a major city could lead to insured losses as high as those caused by Hurricane Andrew.

Insured losses from Andrew, which made landfall in 1992 as a category five storm in south Florida, came to $15.5bn, which would be approximately $30bn today.

The reinsurance programme’s $2bn coverage limit is for all participants in aggregate. But there are some important exclusions and limitations, including a limit on loss adjustment expenses to 10% of the reimbursed value.

Insurers concentrated in Florida or those writing at least 20% of gross written premium in the state have been greatly affected by major hurricanes in recent years.

The overall property loss ratio for this population spiked to 72% with Hurricane Irma in 2017 and was higher than 60% when Hurricane Michael hit a much less populated area in 2018, according to AM Best.

In total, these hurricanes also led to a drop of nearly 20% in policyholders’ surplus, limiting those insurers’ ability to cover future events.

“Property insurance in Florida is already a tough market and this impending hurricane looks to make conditions only more demanding,” Christopher Graham, senior industry analyst at AM Best, said.