Alternative Capital

The emergence of a $30bn global marketplace for insurance-linked securities has served as evidence of the increasingly prominent role third-party capital now plays in risk transfer. Over the medium to long-term this sector is expected to continue its growth as investors take advantage of the low correlation insurance has with other asset classes. This section brings together Insurance Day’s coverage of alternative capital and the way it is helping reshape global insurance markets.

Bermuda regulator consults on new parametric insurer class

BMA business plan focuses on group supervision, climate risk and investments

QBE Re completes first casualty sidecar

George Street Re transaction provides more than $550m in fully collateralised quota-share reinsurance

Farmers closes $400m catastrophe bond

Multi-year bond provides collateralised protection against US named storms, earthquakes, severe weather and fire

Abu Dhabi consults on solvency and ‘synthetic sidecar’ rules

Regulator seeks to encourage local alternative capital markets while aligning with international frameworks

Beazley completes $300m cyber catastrophe bond

Specialty carrier sponsors seventh and largest cyber catastrophe bond with innovative sub-layer structure

Mapfre Re adds to retro protection with €125m catastrophe bond

Carrier returns to catastrophe bond market with upsized deal to protect European portfolio

Beazley plans cyber ILS fund launch

Carrier plans joint venture with existing ILS provider as part of Bermuda build-out

Moody’s publishes new system for rating ILS

New framework uses exceedance probability curves to assess insurance-linked securities

Scor ILS hits $5bn AUM threshold

Scor entered ILS market in 2011 and now has three funds

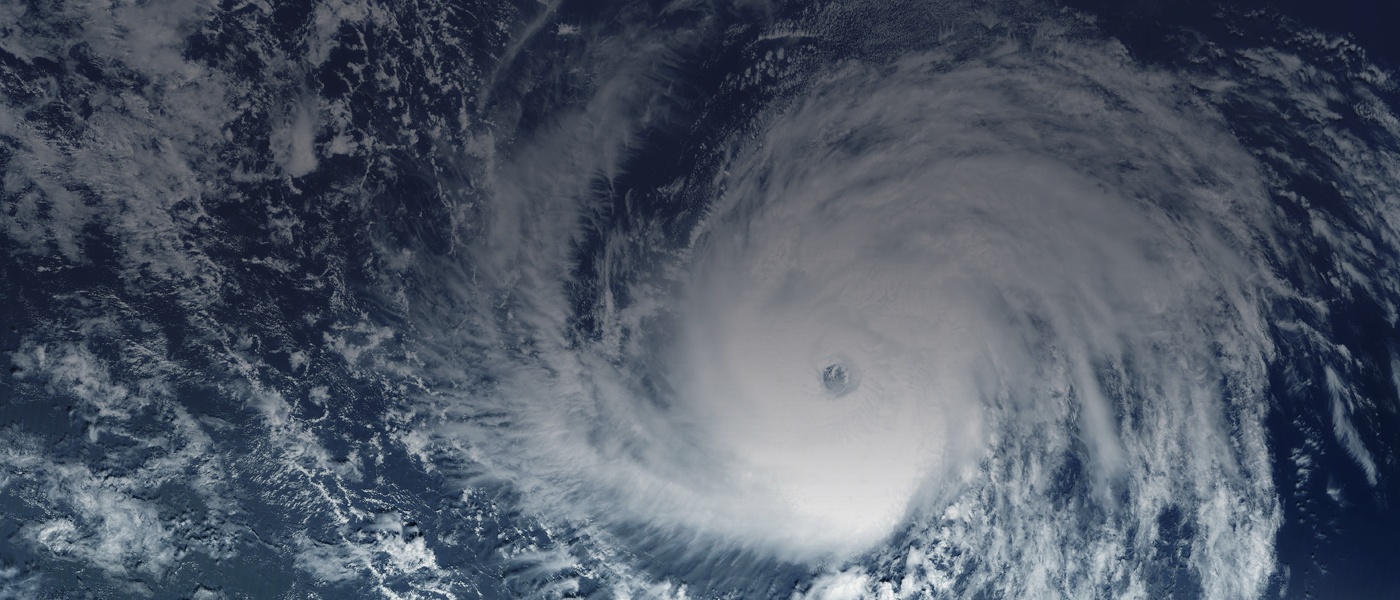

Jamaica cat bond will pay out in full, World Bank says

Major modelling firms put insured losses between $1bn and $5bn

PRA encourages insurers to innovate

Insurers urged to ‘light the blue touch paper of innovation’

US casualty reinsurance capacity 'adequate' going into 1/1

Capital levels in the market are stable as both insurers and reinsurers have a better grip on risks and exposure, Nick Nudo, Aon’s US casualty reinsurance leader says

You must sign in to use this functionality

Authentication.SignIn.HeadSignInHeader

Email Article

All set! This article has been sent to my@email.address.

All fields are required. For multiple recipients, separate email addresses with a semicolon.

Please Note: Only individuals with an active subscription will be able to access the full article. All other readers will be directed to the abstract and would need to subscribe.