Lloyd’s is ‘failing to stop’ fossil fuel expansion among its MGAs: Reclaim Finance

Munich Re Syndicate and Argenta Syndicate have gone ‘significantly further’ than Lloyd’s guidance

‘Only half of Lloyd’s top 20’ managing general agents have adopted Lloyd’s current recommendations on not insuring new coal, tar sand and Arctic energy projects

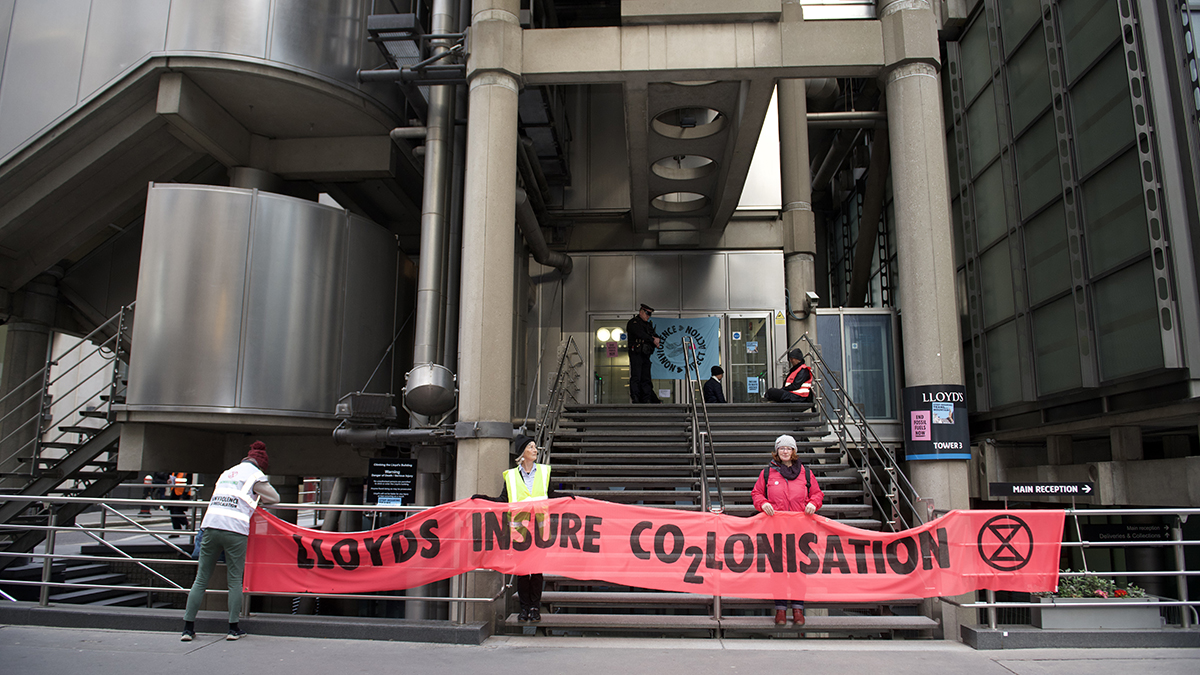

Lloyd's is "failing to meet the litmus test for climate responsibility", of stopping fossil fuel expansion, according to new analysis of Lloyd's top managing general agents (MGAs) by campaign group Reclaim Finance.

Lloyd's fossil fuel policy has, so far, only focused on coal and some unconventional oil and gas projects, which is inconsistent with the net-zero pledge it has made as a member of the Net Zero Insurance Alliance (NZIA), Reclaim Finance said.

Reclaim Finance says its analysis of Lloyd's top 20 MGAs found that seven have not publicly adopted any measures at all on fossil fuels "including the well-known brands" such as Beazley Furlonge and Chaucer Syndicates.

Only half of Lloyd's top 20 MGAs have adopted its current recommendations on not insuring new coal, tar sand and Arctic energy projects, according to the report.

Two, Munich Re Syndicate and Argenta Syndicate, have gone "significantly further", it added, and committed to stop insuring new oil and gas fields.

"Reclaim Finance calls on Lloyd's to set and monitor the adoption of a clear framework for its managing agents that immediately requires Lloyd's managing agents to align their practices with its current and future policy on fossil fuels within a year after adoption by Lloyd's, and set enforcement mechanisms and sanctions if they do not comply after the one-year deadline," Reclaim Finance said.

The group later announced that Beazley had indicated to Reclaim Finance "a few hours before" the release of the report that it has "decided to align" with Lloyd's policy on fossil fuels. Beazley represented around 10% of Lloyd's market in 2021, Reclaim Finance noted.

Ariel Le Bourdonnec of Reclaim Finance said: "Even though the measures taken by Beazley are very weak, as they are limited to coal and exploration for unconventional sources of oil and gas, this is a welcome step forward and we now call other Lloyd's managing agents, including Riverstone Managing Agency and Chaucer Syndicates, to follow suit."

He called on Beazley "to take further steps to align itself with best practice", as defined by Munich Re Syndicate and Argenta Syndicate Management, and the International Energy Agency's net-zero projections for the end of new oil and gas fields and new LNG terminals at 1.5°C.

Insurance Day asked Beazley for its response to this assertion by Reclaim Finance.

The company said: "Beazley is aligned with the Lloyd's guidelines on underwriting new thermal coal, oil tar sands and arctic energy exploration – which have been in place since January 2022. Our full commitments are publicly available and can be found here. The Reclaim Finance report presents a wholly inaccurate depiction of our business and our policies."

Missing portion

Reclaim Finance's assessment of the top 20 coal and oil and gas policies reveals Lloyd's is "still missing a major portion" of its environmental, social and governance (ESG) targets related to fossil fuels, more than two years after Lloyd's released its first ESG guidance for its MGAs.

"Rather than allowing its managing agents to pick up several indicators on the ESG menu, we call on Lloyd's to set and monitor the adoption of a clear framework for its managing agents regarding their support for new fossil fuel projects," Reclaim Finance said.

This framework must include three "minimum guarantees", it said, on underwriting practices and transparency.

The first of these is immediately to require Lloyd's MGAs to align their practices with its policy on fossil fuels within a year after adoption by Lloyd's and set enforcement mechanisms and sanctions if they do not comply after the one-year deadline.

The second is to condition the approval of any new MGA to full compliance with Lloyd's fossil fuel guidance, making it mandatory for them to follow its fossil fuel guidance. This commitment must apply to current and future guidance on coal and oil and gas, which is updated annually.

The third is to monitor and transparently report in its annual ESG report a summary of all its managing agents policies on coal and oil and gas.

Lloyd's of London’s "unwillingness" to stop its members underwriting coal and fossil fuel expansion "makes a mockery" of its membership of the NZIA and its claims to be a climate leader, Reclaim Finance said.

Lloyd's current fossil fuel policy remains inconsistent, the group said, with its net-zero pledge and it called on Lloyd’s urgently, and no later than July 2023, to update and strengthen its fossil fuel guidance by adding certain minimum standards on underwriting practices for its managing agents.

This minimum is to immediately stop offering any insurance and reinsurance services that support the expansion of coal, oil and gas production, and phase out within two years all insurance services for fossil fuel companies that are "not aligned with a credible 1.5°C pathway".

"Lloyd's of London managing agents can no longer afford to wait for Lloyd's to implement more ambitious ESG guidelines," Reclaim Finance said.

"We encourage them to adopt comprehensive fossil fuel exclusion policies in line with the best practices of their peers and the recommendations of the Insure Our Future network, including a commitment not to support any new oil and gas projects, instead supporting provision of insurance coverage for renewable energy projects," it said.

"Convinced that Lloyd's of London, and its managing agents, are all aware of the impacts climate change can have on their business, Reclaim Finance calls on them to provide the necessary policies and means within their business to achieve their common climate ambitions."

Reclaim Finance's report, "The Good, the Bad and the Ugly: The Fossil Fuel Policies of Lloyd’s Managing Agents", is here.