Gearing up for the Atlantic hurricane debate at RVS Monte Carlo

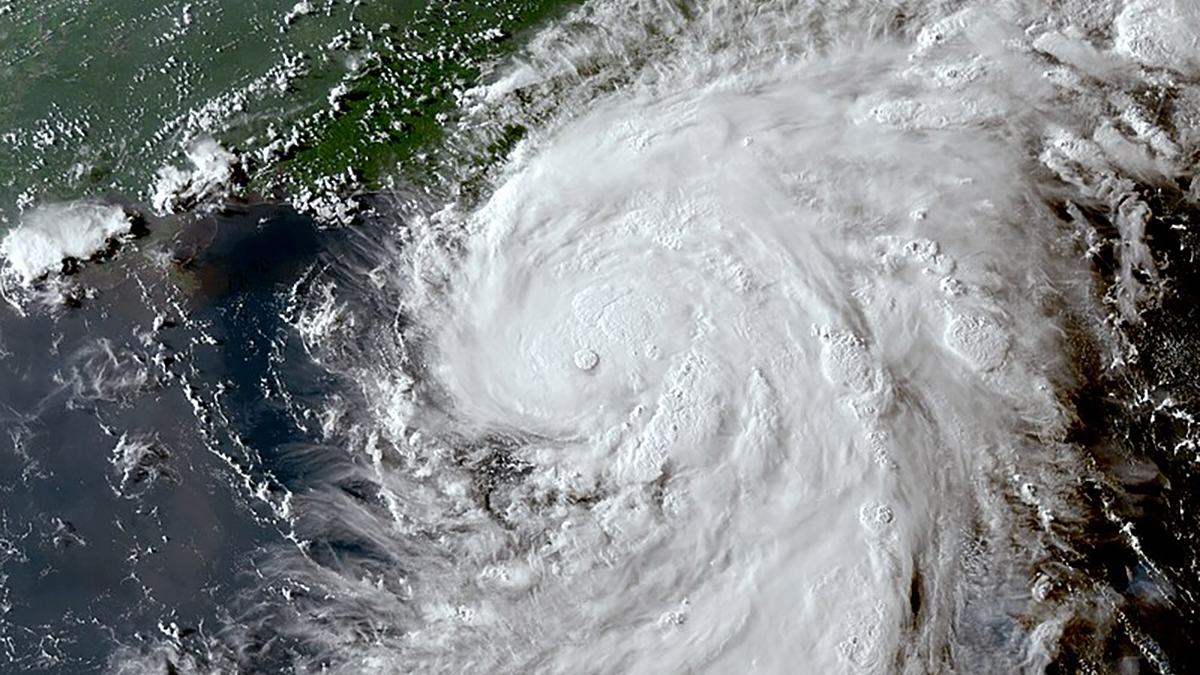

When reinsurers gather at their annual meeting in Monaco next month, an above-normal Atlantic hurricane season will be in full swing

It is generally accepted in hurricane science there will be no increase in the number of tropical cyclones as a result of sea water warming, but they will be stronger and more destructive

Weather forecasters are predicting above-normal hurricane activity in the Atlantic basin this season caused by a number of factors that were discussed at a symposium on hurricane risk in a changing climate earlier this year.

Following the symposium, I co-wrote a chapter in a new book, Advances in Hurricane Risk in a Changing Climate. I co-wrote the chapter with Robert Marsh, professor of oceanography and climate at the University of Southampton, Jeremy Grist, senior research fellow at the UK National Oceanography Centre, and Dipanjan Dey, assistant professor in the School of Earth, Ocean and Climate Sciences at the Indian Institute of Technology. The book’s foreword is by world-leading climate scientist Kerry Emanuel, professor of atmospheric science at the Massachusetts Institute of Technology.

My co-authors and I conclude changes in the speed of ocean circulation will be the main cause increasing warm water volume available in the north Atlantic for hurricane development.

Our conclusions were reached using a high-resolution climate model run from 1950 to 2050 with high human-caused greenhouse gas emissions.

Contributing factors

This year, higher-than-average sea temperatures, combined with cooler temperatures developing in the Pacific as La Niña sets in, are contributing to reduced Atlantic trade winds and less vertical wind shear – therefore favouring tropical storm formation.

National Oceanic and Atmosphere Administration (NOAA) National Weather Service forecasters are predicting above-normal hurricane activity for the 2024 Atlantic hurricane season, which takes place between June 1 and November 30.

The NOAA is forecasting a range of 17 to 25 total named storms with winds of 39 mph or higher. Of those, eight to 13 are forecast to become hurricanes with winds of 74 mph or higher, including four to seven major hurricanes of category three or higher, with winds of 111 mph or higher.

There is much we cannot predict about the climate as we do not know exactly how this increase in warm water for hurricane development will interact with changes in atmospheric stability. It is generally accepted in hurricane science there will be no increase in the number of tropical cyclones as a result of this sea water warming, but they will be stronger and more destructive.

Despite a potential drop in the frequency of all tropical cyclones, we could potentially see more of the major hurricanes that cause the worst damage and loss of life and have the biggest societal impact – an area of concern for reinsurers at Monte Carlo as they discuss risks likely to occur over the next 12 months.

Worrying pattern

While there has not been a detectable trend of increasing major US hurricane landfalls, reinsurers should be aware of a pattern of fewer but more severe events in the Atlantic basin. However, it is impossible to accurately predict the future impact of these severe storms on the re/insurance industry as the amount of damage they inflict depends on where the track is.

If it is over the ocean or a sparsely inhabited area there will be limited damage, whereas if it strikes a major city such as Houston, New Orleans, Tampa or Miami, there could be huge destruction and loss of life, as well as major losses for the reinsurance industry.

While reinsurers should be aware of changes to future Atlantic hurricane seasons, it is not the frequency and severity of tropical cyclones that have driven changes in untrended losses, but population movements towards the coast as well as an increase in wealth and inflation

We were lucky in 2023 with only one major hurricane landfall – Hurricane Idalia, a category three storm, whose track avoided causing significant damage across parts of the south-eastern US. On the other hand, you can have a year like 1992 when Hurricane Andrew was the only hurricane of the season, but it caused enormous damage because it made landfall in Miami and subsequently shaped the property catastrophe sector.

While reinsurers should be aware of these changes to future Atlantic hurricane seasons, it is not the frequency and severity of tropical cyclones that have driven changes in untrended losses, but population movements towards the coast as well as an increase in wealth and inflation. Building codes and claims litigation also materially affect storm losses.

It was a great honour to contribute to this book, which will appeal not only to academics but policymakers and the insurance industry, who all have an interest in the way hurricane risk is evolving as a result of climate change and climate variability.

Elizabeth Harris is vice-president of modelling and research at Ariel Re