Are infrastructure assets back in vogue?

Population growth in low- and middle-income countries will need to be coupled with a commensurate level of investment in infrastructure

Infrastructure assets can bring huge social and economic benefits

In a world of fast-paced technological change, where the buzzwords of the day are “AI” and “bitcoin” to many in the investment world, the infrastructure asset class has lost its appeal.

Infrastructure assets might be seen as vanilla but when they are structured in the right way and the risks allocated correctly, including to risk mitigation providers, these assets can bring huge social and economic benefit. From an investment perspective they are predictable and in today's world, that is very hard to come by.

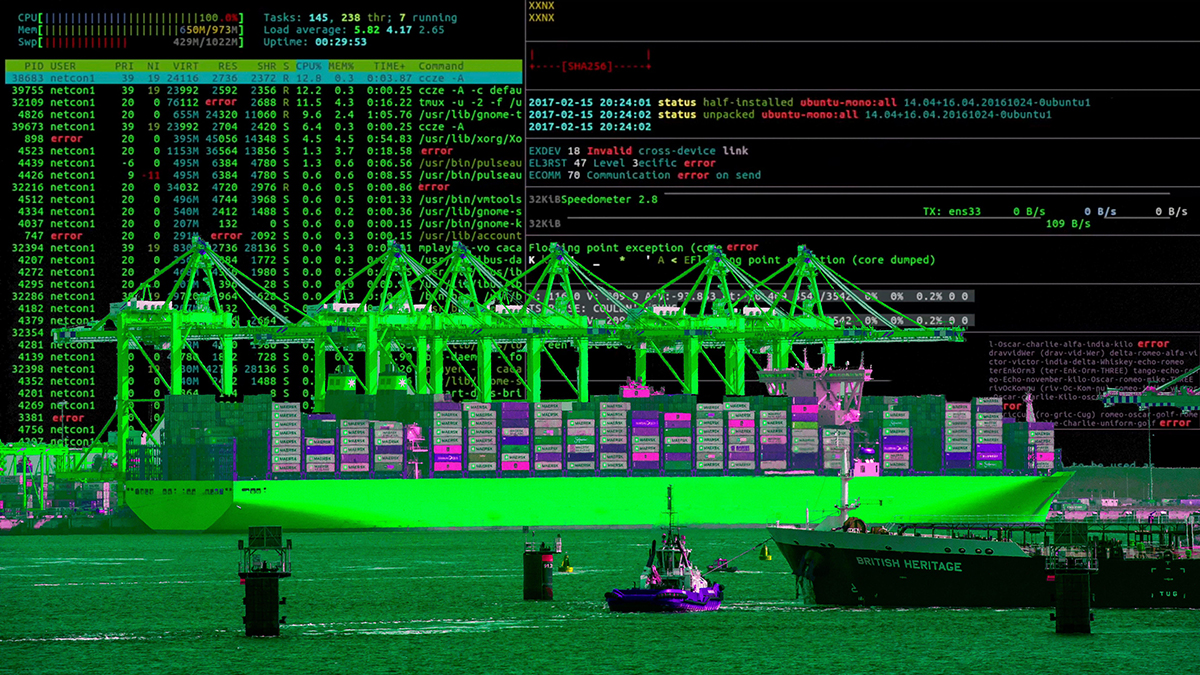

The definition of infrastructure varies from one organisation to another. In this context, it is referring to long-life capital-intensive assets, that are stationary in nature, provide an essential service and have long-term stable cashflows, when structured appropriately. This could include, for example, water systems, social infrastructure (schools and prisons), digital (data centres, fibre), and transportation (ports, rail, roads and bridges) among other things. What it does not include is energy assets.

Renewed interest

January 2024 saw the announcement of the acquisition of two leading infrastructure investors by two of the largest infrastructure asset management firms in the world – GIP was acquired by BlackRock and Actis was acquired by General Atlantic. As a result, BlackRock's assets under management will surpass $9trn, and the General Atlantic platform will be around $96bn. The common rationale for acquisition in both transactions is the strong tailwinds behind the infrastructure asset class.

There is a vast amount of commentary on the ageing infrastructure in high-income countries, such as the US and the UK. However, what we are particularly interested in is the potential challenges facing infrastructure in low- and middle-income countries (LMICs) and, more specifically, the role of demographics in infrastructure demand.

Demographic challenges

The global population is expected to increase by two billion people between now and 2050 and much of that growth will come from LMICs. The most populous country will be India, with 1.6 billion inhabitants, and the top 10 countries by population are predicted to include Nigeria, Pakistan, Brazil, Democratic Republic of Congo, Ethiopia and Bangladesh.

This population growth will need to be coupled with a commensurate level of investment in infrastructure for these countries to meet their economic and social development needs. This said, political risk is often cited as one of the primary inhibitors of foreign direct investment into LMICs. This risk, which varies by country and investment, can at times be perceived and at times be real. Nonetheless, it is an important factor at play, which is often a key reason for final investment decisions not being made and capital not flowing to where it is needed the most.

In terms of the direction of travel, I would argue that, broadly speaking, political risk will increase because of the increasingly fragmented nature of the geopolitical landscape and the downstream impact this will have on the investment environment in many, if not all, countries.

Collaboration is key

Research suggests there is a $15trn infrastructure investment gap in LMICs between now and 2040. While multilateral and development finance institutions are deploying vast amounts of capital to such assets, their balance sheets alone will not be enough to fill the void. For example, there is estimated to be more than $30trn of “dry powder” sat on the balance sheet of institutional investors, which is potentially not being deployed to infrastructure assets in LMICs because of factors such as political risk.

It is therefore important there is increased collaboration between such entities and a wide range of other investors in the sector, be they lenders or political risk guarantee providers.

Unlocking the necessary level of investment will require comprehensive solutions that bring capital to projects and jurisdictions where it essential. Bringing together these different stakeholders can be an effective way to leverage shared expertise, around governance, sustainability, country risk analysis, financial structuring and so on.

Furthermore, it leverages the full financial scale of both the private sector and the public sector in jurisdictions where the host government balance sheet is not sufficiently strong. If done successfully, you never know, infrastructure might be back in vogue.

Will Limb is head of political risk solutions at Liberty Specialty Markets