Climate Risk

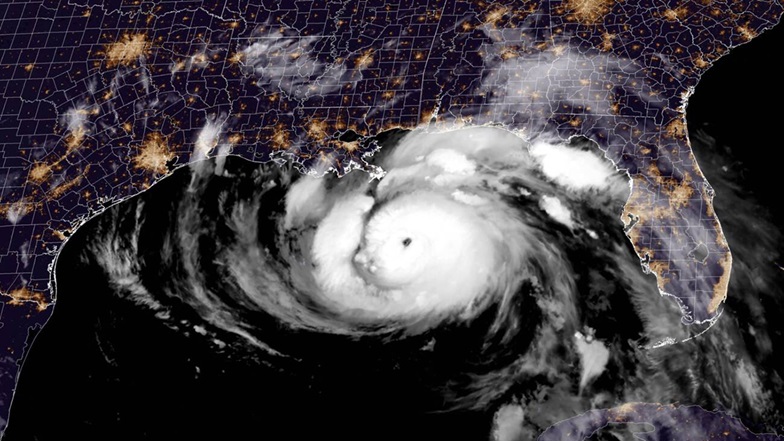

The UN held its first climate talks as long ago as 1990, yet the participation of insurers in helping to tackle what is now described as a climate crisis is starkly recent. Moreover, as extreme weather events become more frequent, severe and interconnected, what are the roles re/insurers can play in managing the challenge of climate risk, not merely for their policyholders but for the global community?

Climate risk is more than a weather forecast

Above all the noise about climate risk, re/insurers should be a voice of clarity, says Steve Bowen from Gallagher Re

Underscoring climate risk in rating methodology

Climate risk impacts the financial strength and creditworthiness of a re/insurer

Calculating the value of nature

Axa XL aims to establish a ‘comprehensive baseline’ for nature in its portfolio

Slow-onset climate hazards pose unique risks

Many of the most devastating impacts of climate change, especially for coastal and island nations, will be chronic and slow-onset

Taking social good further through public-private partnerships

Insurance helps societies get back on their feet, but through public-private partnerships, it can prevent them falling over again (and again)

Ensuring resilience for the uninsured

‘Inclusive insurance’ is the term used to describe the industry’s efforts to reach unserved, underserved, vulnerable or low-income populations in emerging markets with appropriate products. Many of these populations are located in areas suffering the worst impacts of climate change

Human rights and the environment create new liabilities

The EU Corporate Sustainability Due Diligence Directive will introduce a mandatory human rights and environmental framework

Climate change is forcing the evolution of risk

Recent years have shown that the ‘unthinkable’ really can happen, says Axa's chief risk officer Renaud Guidée

Re/insurers need to rethink climate risk and reward

Alaska and California are very different states, but their insurance commissioners have the same message on how to approach natural catastrophes linked to climate change

Embedding sustainability requires genuine change

While engagement and collaboration with insureds is key, a commitment to sustainability requires the re/insurance industry to sometimes say no

A hard market brings responsibility

African Risk Capacity ‘has not been spared’ hardening catastrophe reinsurance pricing

Making the polluters pay

Re/insurance is becoming unaffordable or unavailable, especially to those particularly exposed to climate risk and the public purse should not be the go-to solution

You must sign in to use this functionality

Authentication.SignIn.HeadSignInHeader

Email Article

All set! This article has been sent to my@email.address.

All fields are required. For multiple recipients, separate email addresses with a semicolon.

Please Note: Only individuals with an active subscription will be able to access the full article. All other readers will be directed to the abstract and would need to subscribe.